What Does a Public Insurance Adjuster Do?

Have you ever heard the term Public Insurance Adjuster? Do you know what a public insurance adjuster does and how it can benefit you?

Public insurance adjusters or public adjusters are a type of public insurance representative that works to get you a reasonable settlement from your insurance company. With insurance companies, the public adjuster takes on the responsibility of dealing with disputes and negotiating settlements for their clients. They also have an important role in identifying what is covered by your policy and what isn’t.

How Can I Get A Larger Settlement?

If you want to make sure that you get all the benefits offered by your insurance policy and the largest settlement possible, it’s worth contacting a public insurance adjuster today!

What Does a Public Insurance Adjuster Do?

They are professionals that work to get you the best settlement possible from your insurer. They can help identify what is and isn’t covered by your policy, and they will deal with any disputes or negotiations on your behalf. If you’re looking for the best chance of getting all of the benefits offered by your insurance company, it’s worth contacting one.

A Public Insurance Adjuster Can:

- Serve as your exclusive advocate and representative in all communications with your insurance company.

- Analyze your homeowners or commercial insurance policy to develop a claim strategy that ensures you receive everything your policy promises.

- Dig deep to document the full extent of damage to your home or building(s), personal property, or business personal property.

- Prepare and reach an agreement with your insurance company on a proper scope of loss to reduce construction cost overruns and other out-of-pocket expenses.

- Educate, advise and communicate openly with you, so you can make informed decisions about your options throughout your property insurance claim process.

- Provide undeniable proof of loss for your:

- Home or Building(s)

- Personal Property

- Additional Living Expenses (ALE)

- Loss of Income/Business Interruption

- Replacement Cost Value (RCV) reimbursement

- Negotiate for the maximum settlement available under the terms of your commercial or homeowners insurance policy.

Achieving all of this within the time frames defined in your policy is no small task, especially if you’re dealing with a large loss. That’s why JF O’Toole Public Adjusters has on-staff estimators, loss consultants, personal property specialists, and other insurance professionals all supporting the public adjusters. No detail is overlooked.

Doesn’t My Insurance Company Provide a Claims Adjuster?

In most cases, the insurance company will provide an adjuster to work on your claim. However, it is important to remember that the adjuster works for the insurance company – not you. Their claims adjuster’s job asses the claim — a process designed to reduce claim costs and bolster profits.

You should have the same advantage as the insurance company by engaging an insurance adjuster who works for you and has your best interests in mind. Their goal is to get you enough money in a settlement to return your property to its pre-loss condition.

Public Adjusters are Licensed Professionals. They are also are the only insurance claims adjusters who represent and advocate exclusively for commercial and homeowners insurance policyholders.

Doesn’t my Insurance Company Have to Pay me What my Property Claim is Worth?

Unfortunately, insurance companies are not required to pay you the full value of your property claim. In fact, they are often quick to low-ball your claim to settle without paying out much money. They’re hoping they can persuade you to walk away without getting a full settlement.

Your policy requires you to prove the full extent of your damages. Certainly, your insurance carrier will take on the task of processing your claim. And they will make a settlement offer. It may even appear to be an iron-clad, computer-generated, scientific calculation that was drawn from software that’s updated from time to time. But in reality, it’s “garbage in, garbage out.” The computer-generated estimate will only output what the adjuster puts into it … which is usually a minimal scope of work. Meaning you’ll get a minimal payout.

Remember these Four Insurance Claims Facts:

- Unclaimed damages are common.

- Valuation is subjective.

- Insurance company adjusters are known to estimate losses low.

- Scope of work to return to the pre-loss condition

Your claim value is likely to change substantially when evaluated by a public adjuster working in your best interest. See our Recent Recoveries page for specific amounts we have recovered.

Three Types of Insurance Claims Adjusters

There are unique types of insurance claim adjusters:

- Public Adjusters: The policyholders themselves and not the insurance company hire public adjusters.

- Independent Adjuster: Outside adjuster contracted by the insurance company. Usually from large corporations who agree to the insurance company’s pre-set protocols.

- Staff Adjusters: Staff adjusters are hired by the insurance company. They are either outside contractors or more often work within the company itself.

Public adjusters are sometimes seen abbreviated as PA’s.

So out of all the classes of insurance claim adjusters, public adjusters are the only ones who are independent of insurance companies. They are hired by the policyholder to go over the claim and to ensure that they receive the correct amount of money. The goal is to get the insurance company to cover the entire damage or loss to their buildings or property from a disaster or accident.

History and Experience of Public Insurance Adjusters

Public adjusters first appeared back in the 1920s. They were put into place to ensure that insurance companies would pay all claims from clients and not try to reduce costs by underpaying for a claim or denying it altogether.

The public adjuster’s job is simple: they look over your policy, determine what you are owed, and then fight on your behalf to get the full settlement.

Most good public adjusters are not only state-licensed but also have years of experience working in the highly complex insurance industry.

How Much Does a Public Adjuster Cost?

Public adjusters generally charge a percentage fee based on the total settlement achieved for the policyholder. If you’ve already started a claim, some adjusters only take a percentage of the money they receive above the initial insurance company offer.

While rare, some special circumstances allow for higher or lower fees. It’s important to clarify up front exactly what a public adjuster will charge to manage your claim.

It’s equally important to ask about the value he or she will deliver for that fee. J.F. O’Toole will not take on a claim unless we are sure that we can add substantial value for the policyholder.

It is common for your public adjuster to become a payee on your insurance claim checks. Meaning that any checks sent by your insurance company will be made out to you and your public adjuster.

If you have a mortgage, the lien holder also will be a payee, as will any other parties with insurable interests.

What Are Public Insurance Adjuster’s Duties?

A public adjuster acts as your representative to the insurance company.

Their objective is to navigate all stages of the claim process and advocate for the best interests of the insured.

They advise, assist and manage all of the details with filing a claim to your insurance company. This allows the insured to focus on other, more important tasks instead of dealing with the stress of insurance negotiations. This is particularly helpful in the days and weeks following a loss.

There are many different duties that public adjusters perform for the policyholder:

- Determine Coverage: Assess and examine the insurance policy and determine what coverage and limits apply.

- Estimate: Evaluate any losses to the policyholder’s home, business, or personal property and the amount of money necessary to return it all to the pre-loss condition.

- Inspect: They record, investigate, and then validate all damages done to the property. They also determine any extra expenses that you might require.

- Evidence: They record, document and validate the claim as a representative of the policyholder

- Negotiate: They present the evidence, discuss and agree on an appropriate payout with the insurance company

If there is a disagreement about what an appropriate settlement is, the public adjuster can reopen, renegotiate, or provide guidance on the next best course of action. Always focused on the goal of achieving a fair and favorable settlement for the insured.

You should consider hiring a public adjuster if you are dealing with a claim of more than $10,000 dollars. Another reason to get help is if you feel unsure about what your insurance policy covers or if you’re feeling short-changed.

Qualifications for Public Adjuster to Represent You

Public adjusters have to be licensed and pass a state certification test. They also have to be bonded and carry insurance against malpractice.

Some insurance adjusters have more experience and will do a better job. It’s always helpful to ask for references or to see a list of recent recoveries to gauge the adjuster’s ability.

Insurance Claims and Policy Experts

Not all insurance claims follow a set path. There are always differences and issues that have to be navigated. A competent adjuster needs to prove three things:

- Loss conditions meet the standards for coverage.

- Policy language ensures coverage.

- That the settlement amount will completely restore the policyholder’s property to pre-loss condition.

Any suggestion that proving these things is easy, or that a computer can do it for you, just isn’t true. Claims very quickly become a tangled mess because the:

- Loss conditions are not clearly stated, not properly evaluated and documented, or they include multiple causes or several policies.

- Policy language is unfamiliar, difficult to understand, and subject to interpretation.

- Offered settlement amount is insufficient to cover the loss.

- They often do not meet the standards of the industry.

Experienced public adjusters are experienced in reviewing and understanding policies and work on property claims on a daily basis They’re experts at understanding the policy language, and overcoming issues that arise. They also can determine the best way to apply the combined coverages your policy offers to maximize your settlement.

Buildings and Personal Property Experts

The scope of loss from your damages begins with a detailed list. That means knowing where to look and what you need for that purpose, so there aren’t any surprises when it comes time for demanding compensation.

The last thing a public insurance adjuster wants is an unhappy client. So managing expectations and doing a thorough evaluation before challenging the insurance company is a must.

Business Loss Experts

We all want to protect our businesses and property from the risks of disaster. But when severe damage leads to physical damages but also loss of revenue or income and other extra expenses like relocation you really need an advocate.

This is where having an expert on your side comes into play:

- The complexities of these claims grow exponentially – often leaving policyholders unfairly subsidized by their insured losses while they wait out this difficult time period without any financial assistance available for business interruption services!

- A public adjuster should have experience and expertise during trying times to analyze insurance policies so you don’t have to worry about covering substantial costs out of pocket.

- Providing full accounting based on applicable coverage with no hidden fees added to it.

Negotiation Experts

The negotiating process starts as soon as you incur a loss.

In the event of a loss, it’s important to be prepared and have all your documentation at hand. If the loss is substantial, you may want to reach out to a public insurance adjuster first. But you should notify your insurance company as soon as possible.

This way they can reach out with their adjuster for verification purposes.

Be aware that they will be evaluating how much you know about your policy limits, the damages you have sustained and if you are looking to an agent, public adjuster or insurance carrier for advice.

A public adjuster breaks the assessment cycle, stepping in as your exclusive professional representative.

With a level playing field, lots of documentation, and iron-clad proof of all valuations, it is difficult for the insurance company to argue for anything less than a full and fair settlement.

How Much More Will A Public Insurance Adjuster Earn for Me?

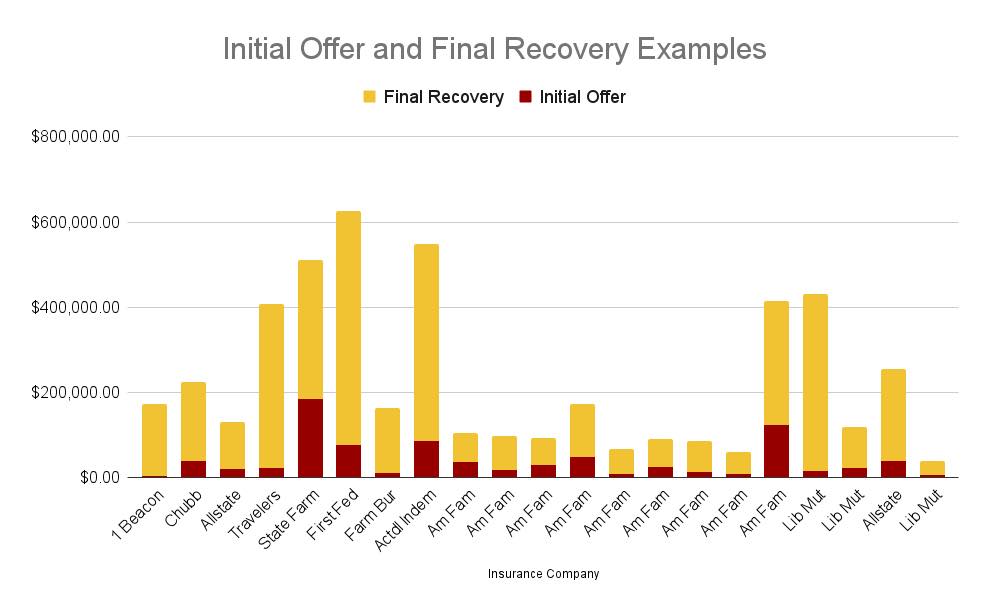

There is no guarantee of how much more of a settlement you will receive when you involve a public adjuster. All we can do is share what we have won for clients. The chart below shows some of the more modest claims that we’ve helped to settle. As you can see in every instance we earned our clients at least double the amount of the original insurance company offer.

What if There’s a Dispute or Problem With my Claim?

Claim disputes are common. Remember that there is a lot at stake, and the insurance company has lots of experience in controlling outcomes.

It’s easy for emotions to run hot, especially when you’re the one with everything to lose. If brought in early, a licensed public adjuster can become the equalizer for you.

When disputes arise, your public adjuster will know what to do and work to resolve the problem efficiently. Sometimes it’s as easy as providing an explanation or additional documentation. Other times, it’s as challenging as knowing when to invoke appraisal or recommend the policyholder pursue a bad-faith lawsuit for breach of contract.

If you’re currently involved in a dispute over your claim, then the professional public adjuster is just what you need. Some common claims disputes that they can resolve include:

- Underpaid claims

- Wrongfully denied claims

- Lengthy delays

- Lowball settlement offers

- Overreaching procedural requirements and general mistreatment

- Slow pay of undisputed payments

- Examination under oath (similar to a deposition)

- Appraisal

Until you’ve agreed to a final settlement for your commercial or homeowners insurance claim, there’s still time to get an expert claim review.

How to find a good public adjuster?

The quality and experience of public adjusters vary, so choose carefully.

Follow these tips:

- Make sure the adjuster is licensed in your state. Many state insurance departments, which regulate public insurance adjusters, let you verify licenses online.

- Read the contract and understand the fees before hiring the adjuster

- Stay away from anyone demanding an upfront fee or pressuring you to sign a contract. Disasters bring out scam artists — unqualified people who pose as public adjusters and take advantage of vulnerable people.

Why Hire a Public Adjuster and not an Attorney?

An experienced property claims attorney is the right choice if your insurance claim has gone so far off the rails that you need to file a lawsuit against your insurance company. Until then, an attorney can’t do much more than draft a letter and request that your insurance carrier complies with the terms of your policy.

A public adjuster, however, serves as your exclusive advocate at every stage of your property insurance claim process. When handled by a licensed claim professional, most homeowners and commercial insurance claims can be settled successfully and without the need to file suit.

Now you know the answer to the question: What does a public insurance adjuster do?

James F. O’Toole – Public Insurance Adjuster

If you have an insurable loss, it’s important to hire a public insurance adjuster to ensure that you get fair and complete compensation. To learn more about how Jim O’Toole can help with your claim or for information on his free consultations, contact him today.

Known as one of the foremost Public Insurance Adjusters in the Southwest, Jim O’Toole got his start in 1976 at the young age of 17. He learned the claims adjusting business at the heels of his father James O’Toole Sr.

Read more about Jim and what he can do for you.